Why You Must Take Into Consideration an Offshore Depend On for Shielding Your Properties and Future Generations

If you're looking to secure your wide range and ensure it lasts for future generations, thinking about an offshore count on might be a smart action. As you discover the potential of overseas depends on, you'll discover exactly how they can be customized to fit your particular demands and objectives.

Comprehending Offshore Depends On: What They Are and Exactly How They Work

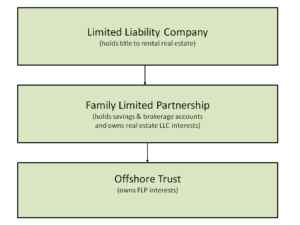

When you think about protecting your properties, offshore depends on could enter your mind as a feasible option. An offshore count on is a lawful setup where you move your assets to a trustee located in one more nation. This trustee takes care of those properties in behalf of the recipients you designate. You maintain some control over the trust, but the legal ownership shifts to the trustee, supplying protection from possible creditors and legal insurance claims.

The key elements of an offshore depend on consist of the settlor (you), the trustee, and the recipients. You can personalize the depend your requirements, defining exactly how and when the assets are distributed. Since these trusts typically run under desirable regulations in their jurisdictions, they can give improved personal privacy and safety for your riches. Recognizing how offshore counts on feature is essential before you make a decision whether they're the best choice for your asset defense method.

Benefits of Developing an Offshore Depend On

Why should you think about developing an offshore trust fund? Furthermore, offshore depends on offer flexibility regarding possession administration (Offshore Trusts).

One more trick benefit is privacy. Offshore trust funds can give a higher level of privacy, securing your economic affairs from public examination. This can be important for those wishing to maintain their riches discreet. Establishing an overseas trust fund can promote generational riches conservation. It permits you to establish terms for how your properties are distributed, ensuring they profit your future generations. Eventually, an offshore depend on can function as a calculated device for securing your economic heritage.

Safeguarding Your Assets From Lawful Insurance Claims and Lenders

Developing an overseas trust fund not just supplies tax benefits and privacy yet likewise works as an effective shield versus lawful cases and lenders. When you place your possessions in an overseas depend on, they're no more considered component of your personal estate, making it much harder for creditors to access them. This separation can secure your wealth from suits and insurance claims developing from service conflicts or individual obligations.

With the right territory, your properties can gain from strict privacy legislations that hinder creditors from seeking your wide range. Additionally, lots of overseas counts on are made to be testing to pass through, typically calling for court activity in the count on's jurisdiction, which can work as a deterrent.

Tax Effectiveness: Lessening Tax Liabilities With Offshore Depends On

Furthermore, because depends on are usually strained in a different way than individuals, you can take advantage of lower tax obligation rates. It's essential, nonetheless, to structure your count on appropriately to guarantee conformity with both domestic and worldwide tax obligation laws. Dealing with a competent tax expert can aid you browse these intricacies.

Guaranteeing Personal Privacy and Privacy for Your Wide Range

When it comes to shielding your wide range, assuring privacy and confidentiality is crucial in today's progressively clear financial landscape. An overseas trust can give a layer of protection that's difficult to accomplish with domestic alternatives. By positioning your assets in an overseas territory, you secure your monetary details from public examination and minimize the threat of undesirable interest.

These trusts typically come with strict personal privacy regulations that avoid unauthorized access to your monetary information. This indicates you can protect your riches while maintaining your comfort. You'll also restrict the opportunity of legal conflicts, as the details of your count on continue to important link be personal.

In addition, having an overseas depend on means your properties are less susceptible to individual responsibility claims or unexpected economic dilemmas. It's a proactive action you can require to guarantee your monetary tradition remains undamaged and personal for future generations. Rely on an offshore structure to guard your wealth successfully.

Control Over Property Circulation and Monitoring

Control over possession distribution and monitoring is just one of the key advantages of establishing up an overseas depend on. By developing this count on, you can determine how and when your possessions are dispersed to beneficiaries. You're not just handing over your wide range; you're setting terms that reflect your vision for your heritage.

You can develop certain conditions for distributions, ensuring that recipients meet specific standards before receiving their share. This control helps avoid mismanagement and warranties your properties are made use of in methods you deem appropriate.

Furthermore, selecting a trustee enables you to delegate monitoring obligations while keeping oversight. You can select somebody who lines up with your values and comprehends your goals, ensuring your possessions are handled wisely.

With visit homepage an offshore depend on, you're not only securing your wealth however likewise forming the future of your recipients, giving them with the support they require while keeping your wanted degree of control.

Picking the Right Jurisdiction for Your Offshore Count On

Look for nations with strong lawful structures that support count i thought about this on legislations, making sure that your properties stay protected from potential future claims. Furthermore, ease of access to neighborhood economic institutions and knowledgeable trustees can make a large difference in handling your trust successfully.

It's necessary to assess the prices entailed as well; some jurisdictions might have greater configuration or upkeep fees. Inevitably, picking the appropriate territory means straightening your financial objectives and family requires with the specific benefits supplied by that place - Offshore Trusts. Take your time to study and consult with experts to make the most enlightened decision

Often Asked Questions

What Are the Prices Related To Establishing up an Offshore Count On?

Setting up an overseas depend on entails various expenses, including legal fees, arrangement fees, and recurring upkeep costs. You'll intend to budget for these factors to assure your trust fund operates successfully and effectively.

Exactly How Can I Locate a Reliable Offshore Count On Supplier?

To find a trustworthy overseas trust fund supplier, research study online evaluations, request recommendations, and confirm credentials. Ensure they're knowledgeable and clear about costs, solutions, and regulations. Count on your instincts during the selection procedure.

Can I Manage My Offshore Count On From Another Location?

Yes, you can manage your offshore trust fund from another location. Lots of companies supply online gain access to, allowing you to monitor financial investments, connect with trustees, and gain access to documents from anywhere. Just assure you have safe internet access to shield your details.

What Occurs if I Relocate to a Different Country?

If you transfer to a various nation, your offshore trust fund's policies might transform. You'll require to consult with your trustee and potentially adjust your depend on's terms to follow regional laws and tax ramifications.

Are Offshore Trusts Legal for Citizens of All Countries?

Yes, overseas trusts are legal for residents of several countries, but laws vary. It's necessary to research your nation's laws and get in touch with a lawful expert to ensure compliance and understand potential tax ramifications before proceeding.